OUR TEAM

Our team and those of our affiliates have over fifty years of combined experience in India investing and investment research. We bring a range of professional experience in fields such as private equity, investment banking, equity research, management consulting, corporate management and business journalism to inform a far-reaching, fundamental approach to investment.

Dan Tennebaum

Managing Partner

Dr. Jon Thorn

Director, ICF

Uday Saripalli

CFO and COO

Piyush Goyal

Managing Director

Saket Yadav

Managing Director

Akshay Jain

Associate

Parang Trivedi

Senior Analyst

Tanisha Chandhok

Analyst

Harsh Vidhani

Analyst

Ritik Shah

Analyst

Mahesh Ambokar

Vice President, Technology

Asha Salokhe

Information Technology Analyst

Waheedali Shaikh

Manager, Administration

Our Directors

Harry N. Hoffman

Director, ICM

Nancy Orr

Director, ICM

Win Bennett

Director, ICM

Kapil Dev Joory

Director, ICF

Ameet Parikh

Director, ICR

Christopher Brader

Director, ICM

Couldip Lala

Director, ICF

Raju Jaddoo

Director, ICM

Sudesh Lala

Director, ICM

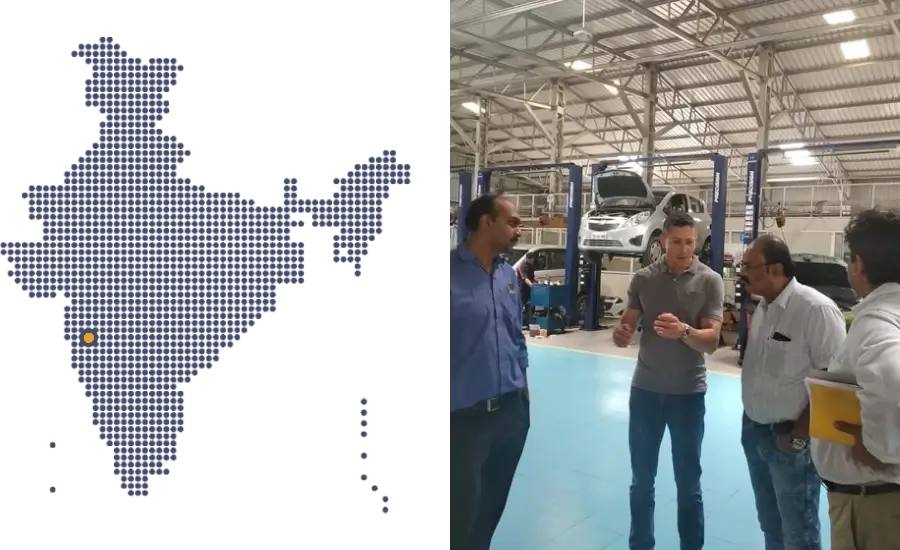

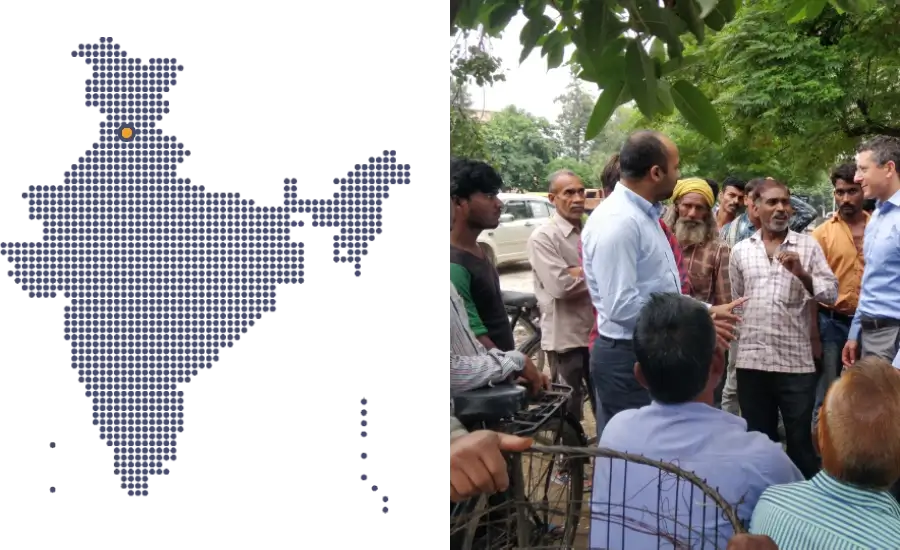

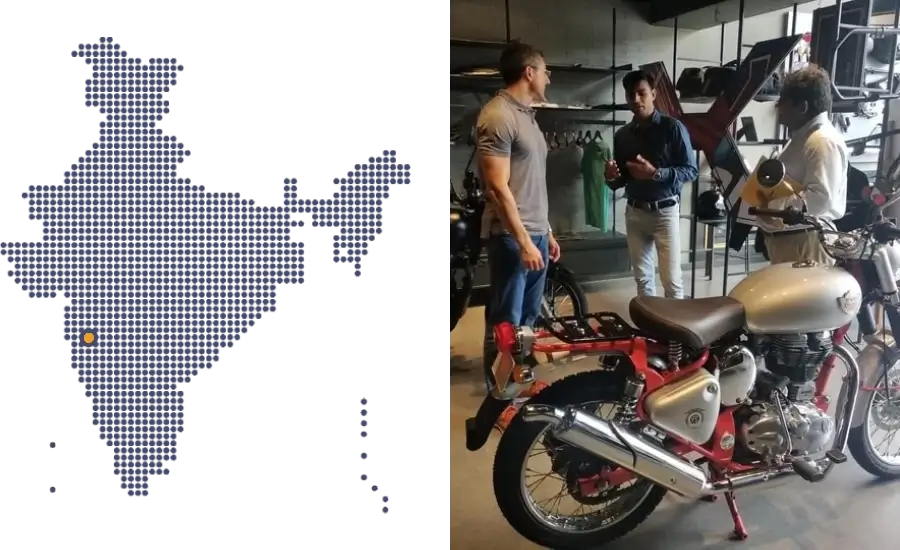

RESEARCH Research is the core of our investment process. It takes us to nearly every corner of India, from executive offices and government conclaves to factory floors, construction sites and agricultural cooperatives. India’s more than 3,000 publicly traded companies are not always well understood by traditional market intermediaries, nor is comprehensive data readily available from secondary sources in many cases. As a result of these inefficiencies, interactions with customers, competitors, suppliers and regulators can yield a genuinely distinctive view of a business. Comprehensive research allows us to identify opportunities that are not widely understood and construct a concentrated, high-conviction and non-consensus portfolio.

Professor Tarun Khanna

Tarun Khanna is the Jorge Paulo Lemann Professor at the Harvard Business School. Since 2010 he has served as the director of Harvard’s university-wide Lakshmi Mittal and Family South Asia Institute. For the past decade, he has also overseen HBS activities across South Asia, anchored in Mumbai.

At HBS since 1993, after obtaining degrees from Princeton and Harvard, he has taught courses on strategy, international business and economic development to undergraduate and graduate students and senior executives.

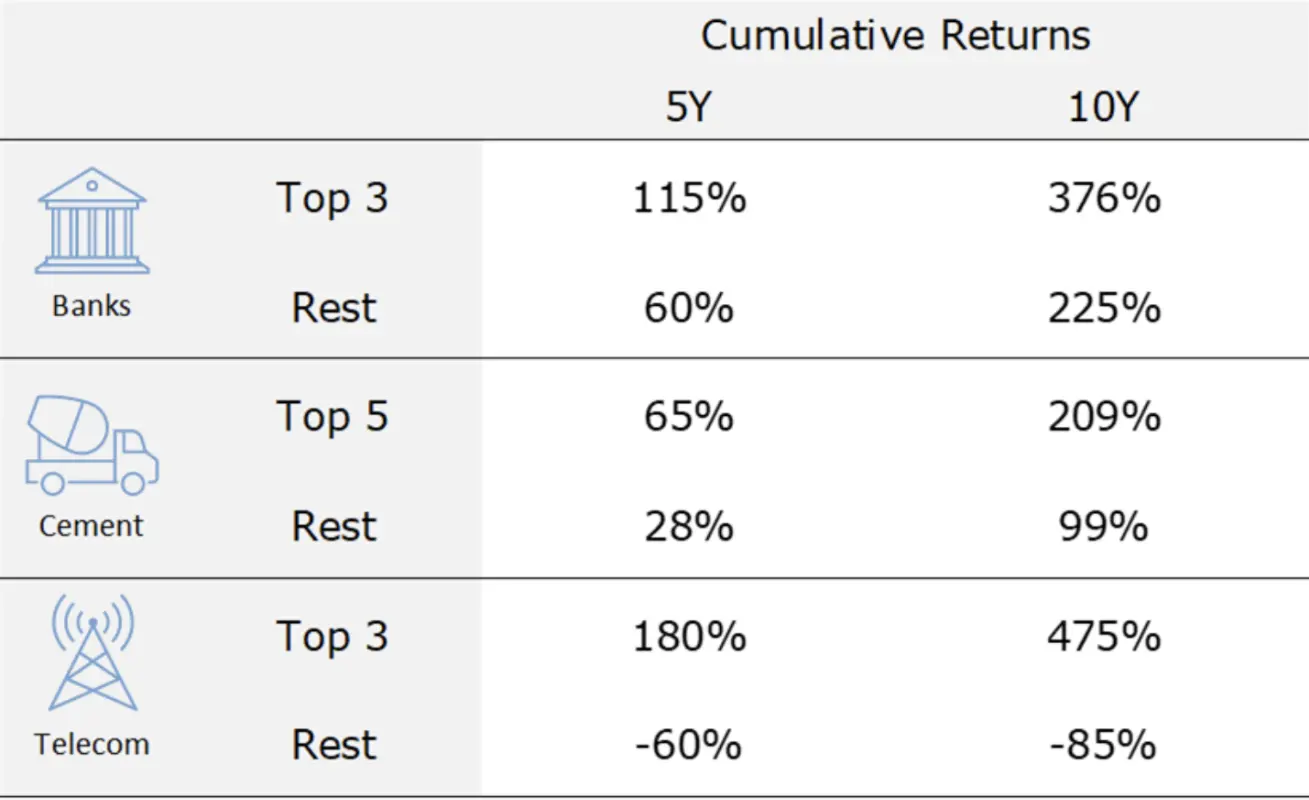

Dan Tennebaum,

Managing Principal

Dan has over twenty years of experience in Indian business and finance, eighteen of them at India Capital. He was previously a Principal at The View Group, a venture capital firm focused on the Indo-US corridor. Prior to View, he was Vice President of business development at India Life, which was acquired by Hewitt Associates. He began his career at Bain & Company and since then has spent more than half of his professional life based in India.

Dan holds an MBA from the Harvard Business School and a BA from Brown University. He has spoken about India at the Kennedy School of Government, the Indian School of Business and in interviews with the Indian and international financial media.

PODCAST

MAY 2024

The Case For India At India Capital

Dan Tennebaum’s interview with Ted Seides on the Capital Allocators podcast.

From Ted: “Dan Tennebaum is the Managing Director at India Capital, a thirty-year-old investment firm focusing on public equities in India. Dan moved to the country twenty-five years ago and spent time in the start-up world and venture capital before pivoting to the public markets in 2007.

Our conversation covers Dan's path from a U.S. Midwesterner to India and the case for public equities. We turn to India Capital’s perspective on sourcing, research, management, regulation, valuation, portfolio construction, risk, and misperceptions, colored with some examples along the way.”

Listen to the full conversation

Listen to highlights

Our investment philosophy

Key risks and common misperceptions

Preventing permanent loss of capital

The case for Indian public equities

Investing in India Vs. China

What we're most excited about now

EXCERPTS FROM OUR YEAR-END INVESTOR CALL

Consumption Is Back

Highlights

Highlights

CURRENT RESEARCH

RESPONSIBLE INVESTING

The India Capital Fund has had an ethical investment policy for more than three decades that mandates, among other things, refraining from holdings in armaments, tobacco and alcohol.

We believe that approach has enhanced our focus on sectors central to India’s responsible growth and strengthened investment performance. Portfolio companies include:

Renewable Energy. One of India’s largest green energy lenders, financing 17 thousand megawatts of renewable power capacity.

Job Creation. India’s largest private sector job creator, with more than 500,000 total employees.

Financial Inclusion. Institutions serving more than 150 million newly banked households and 14 million farmers.

AWARDS

PHILANTHROPY

We and our affiliates are pleased to support a number of organizations that work to improve health and society in India and around the world.

Ajit Deshpande Medical Center

The Ajit Deshpande Medical Center serves more than 24,000 low income patients per year, providing free care in the areas of pulmonology, dermatology, dentistry and more.

The Hospital For Sick Children

The Hospital for Sick Children is recognized as one of the world’s foremost paediatric healthcare institutions and is Canada’s leading center dedicated to advancing children’s health through the integration of patient care, research and education.

In Defense of Animals India

In Defense of Animals India is a grass roots animal protection organization based in Mumbai. The organization provides medical care and adoption services for more than 10,000 stray animals per year.

Conference

Conference